Bond Referendum | November 7

As a district, it is our goal to ensure that every student in the district has an outstanding learning experience supported by facilities that meet the needs of today’s learners.

|

|

THE NEED.

While our facilities have been well maintained over generations of students they served and continue to serve, some have outlived their useful life and others need enhancements to continue delivering the excellent education our families and community expect.

THE GOAL.

Looking to the future, the Dubuque Community School District is committed to responsibly and strategically planning facility enhancements in the district that provide outstanding educational experiences for students while providing the greatest efficiency for district operations.

In an effort to both fund facility enhancements and create efficiencies in district operating expenditures, voters will consider a $150 million bond referendum on the November 7 election ballot. If approved with at least 60% voter approval, the $150 bond would be used to create and modernize facilities, while saving the district approximately $3.5 million in operating dollars annually.

THE PRESENTATION.

View the virtual community information session held on October 24 on Microsoft Teams about the bond referendum. Want a copy of the slides? You can VIEW THE SLIDES IN PDF FORMAT.

THE PROJECTS.

If approved, the bond would allow for the following projects aligned with its long-range facility plan:

|

|

AIR CONDITIONING and HVAC improvements to EXISTING SCHOOLS WITHOUT IT to ensure fully climate-controlled learning spaces. |

|

NEW MIDDLE SCHOOL FACILITY on the WASHINGTON MIDDLE SCHOOL SITE to replace the 100-year-old Washington and Jefferson. | |

|

GYMNASIUM ADDITION to EISENHOWER ELEMENTARY SCHOOL to alleviate scheduling and space constraints with lunch and PE. | |

|

BASEBALL and SOFTBALL FACILITY with LIGHTS, RESTROOMS, and CONCESSIONS to provide safe and competitive facilities. | |

|

LAND ACQUISITION for a POTENTIAL FUTURE ELEMENTARY SCHOOL to allow the district to address long-term needs and population shifts. |

THE IMPACT.

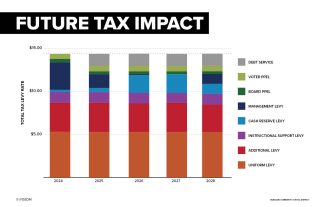

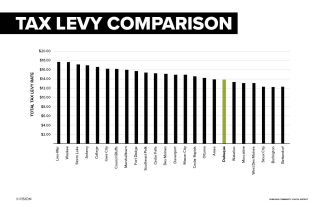

Due to a combination of strong financial management and enrollment changes, the inclusion of the debt service levy to fund the bond can be accomplished with NO TAX LEVY RATE CHANGE.

The rate of $14.51 per $1,000 of assessed property value will remain in place. This represents the district’s fourth-lowest tax levy rate over the past 15 years.

THE TIMING.

The district has long prioritized strong financial management and the efficient use of resources, maximizing the use of one-cent statewide sales tax (known as SAVE) funds to complete over $200 million in facility and construction projects.

There are a number of reasons the district and board have decided to move forward with this proposal now:

- Modern learning spaces greatly enhance a student’s overall educational experience. These projects will provide increased opportunities for ALL students, no matter where they attend school.

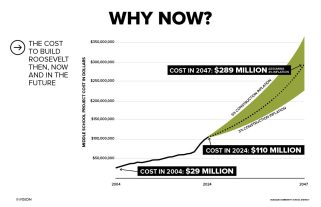

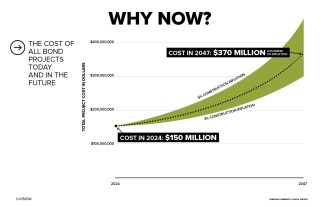

- Without the bond, there will not be enough SAVE funds available to complete these projects. History tells us that construction prices will only increase, and completing these projects now will provide the best return on taxpayer dollars.

- School funding has not kept pace with the rate of inflation or district expenses, placing pressure on the operating budget. Consolidation to two middle schools as part of the bond would provide an estimated $3.5 million in annual operating savings.

THE VOTE.

The bond issue will be on the November 7, 2023, election ballot during the City/School Election. Learn more about ways to vote.

ADDITIONAL INFO.

As we continue to move forward with planning over the next few months, you can stay up to date with the most recent information and answers to frequently asked questions on this page.