Bond Referendum | Frequently Asked Questions

Below are the responses to frequently asked questions about the November 7 Dubuque Community School District Bond Referendum. This page will continue to be updated with new questions added.

Looking for an overview of bond projects? View the main bond webpage for full details.

Questions are organized in the following categories:

- Project Cost Estimates/Timelines

- Air Conditioning

- New Middle School

- Baseball/Softball Facility

- Land Acquisition

- Funding/Financial Impact

Project Cost Estimates/Timelines

What is the estimated cost of projects included in the bond referendum?

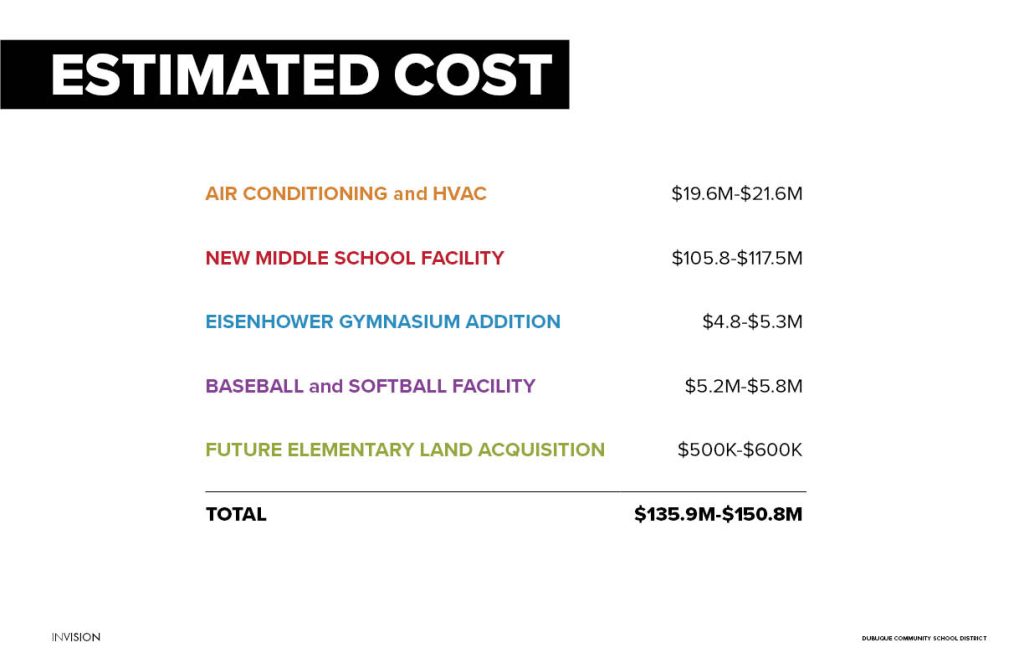

Following are the projected costs for items included in the bond referendum. It is important to note that the district will only bond for dollars needed for these specific projects up to $150 million as outlined in the bond, if approved.

If the bond is approved, when would construction occur and when would projects be completed?

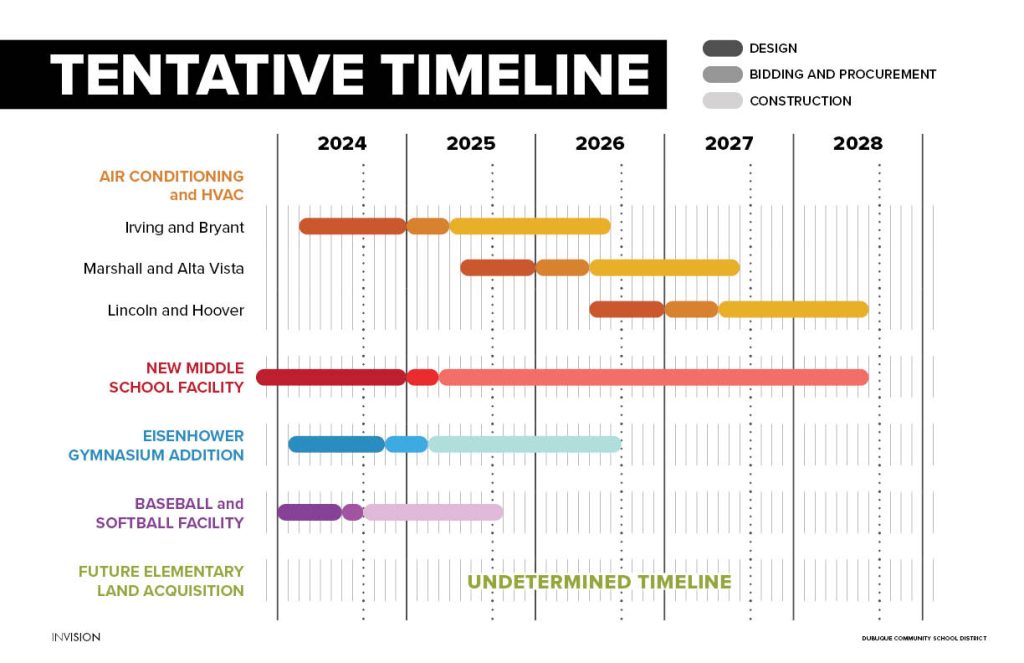

If approved, the district would immediately move into full design, bidding and procurement, and construction phases for each project. Below is the tentative working timeline for each project based on current estimates. NOTE: These timelines are subject to change.

Air Conditioning

If the bond is approved, how long will it take to air condition the remaining schools without air conditioning?

Air conditioning for Washington and Jefferson will be addressed by a move to the new middle school. A more detailed scheduled is being developed for air conditioning the remaining schools, but it is generally anticipated to occur in phases during summers over the next two or three years, with specific timing and completion dates dependent on material availability and contractor capacity.

New Middle School

If the bond is approved, when will the new middle school open?

If the bond is approved, the district would move into full building design and project bidding stages before construction started. Based on tentative timelines, the new middle school would be ready to open in fall 2028 for the 2028-2029 school year.

That means that students who are currently in first, second and third grade during the 2023-2024 school year would be the first sixth, seventh and eighth-grade students to attend the new middle school.

See the full tentative timeline of projects above.

Where would my student attend middle school?

Middle school boundaries would align with the high school boundaries when the new middle school is completed.

Students residing in the Hempstead High School boundary would attend middle school at Roosevelt Middle School and students residing in the Dubuque Senior High School boundary would attend middle school at the new middle school.

Not sure which high school boundary you reside in? Check by address on our Find Your School page.

What will happen to Washington and Jefferson if a new middle school is built?

Washington Middle School and Jefferson Middle School will continue to operate during construction of the new middle school. Once a new middle school opens, the current Washington building would be deconstructed. The Jefferson building WOULD NOT be deconstructed by the district, but would likely be put up for sale.

Baseball/Softball Facility

Where will the baseball/softball facility be located?

A location for the baseball/softball facility has not yet been determined and the site selection process will begin once the bond is approved.

Funding/Financial Impact

How can you have a $150 million bond and not increase the tax levy rate?

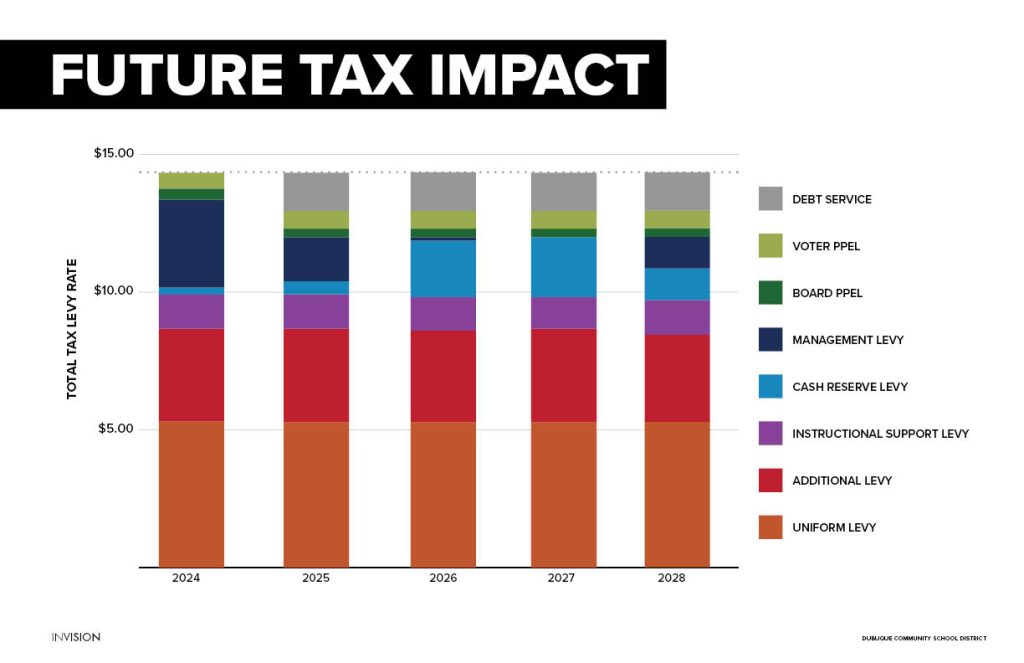

The district’s tax rate will remain unchanged because by planning ahead for this bond, the district is able to reduce other portions of the levy rate. This offsets the addition of the bond levy and ensures there is no tax-rate change.

What will the impact be on district finances if the bond is not approved?

As part of the facility planning process, the district identified the middle school consolidation as a move to both enhance middle school facilities and address operating budget pressures by realizing an estimated savings of $3.5 million in annual operating funds, which fund ongoing programs, services and staffing. If the general obligation bond measure does not pass, those savings would not be realized and the district and school board will assess next steps.

In addition to the estimated annual cost savings, the other improvements the district plans to fund with the sale of general obligation bonds would either not be completed or would need to be funded by other revenue sources, like SAVE revenue or PPEL funds. Unfortunately, those revenue sources are not sufficient to fund all of those projects.

Why not use a SAVE Bond (one-cent sale tax) to fund the projects?

First and foremost, SAVE capacity doesn’t exist to fund all projects included in the referendum. Also, funding the projects with a SAVE bond would:

- Reduce the district’s ability to complete any future projects without a bond at that time

- Reduce the district’s ability to ensure stability in the tax levy rate*

- Cost an additional $8.5 million over time in interest and other bonding costs

* Some available SAVE funds will be used over time to fund general obligation bond principal and interest payments to offset changes in the district’s overall levy rate and ensure it remains at $14.51 per $1,000 of assessed value.

Do the district’s projections on tax impact already account for both principal and interest?

Bonds are the borrowing mechanism that schools use to borrow money for capital projects. In fact, the district uses bonds regularly for capital projects and those bonds always include interest payments.

If the bond measure is approved, the district would sell bonds as funds are needed and make regular debt service payments on the outstanding bonds. Those payments include paying BOTH principal and interest. The district’s multi-year budget model includes paying principal and interest on this $150 million of bonds, if approved, and still projects that the overall levy rate to remain unchanged. Similar to a mortgage, as principal is paid off, the interest cost goes down.

How far into the future does the district project budgets?

Working with our financial consultant that specializes in bonds and tax levy rates, the district annually prepares a multi-year (5-year forward) budget that estimates enrollment, property values and state funding. Based on this projection, the tax levy rate including the bond issue will remain at its current level for at least the current five-year projection period.

It is important to note that over the life of the bonds, the debt service portion of the tax levy will remain generally consistent from year to year and will not balloon in the future. This means that assuming all other factors (slight enrollment decline and low state aid) remain the same, the district’s overall levy would remain stable much beyond that.

In the unlikely event that either significant increases in enrollment or allowed state funding occur after that five-year period, the overall tax levy rate would likely increase based on those facts. It is important to note that those increases would be necessary with or without this bond measure.

Do property owners pay taxes on their full assessed value?

Property owners do not pay taxes on their entire assessed value. Iowa law prescribes a method to “roll back” property assessed values. In the current school year, taxpayers pay taxes on 54.6501% of the assessed value of their home. This is true statewide, regardless of where someone lives.

As an example, the average assessed home value in Dubuque is $159,503. When figuring in the state property tax rollback, the owner of that home pays taxes on $87,169. With the current district tax levy rate at $14.51 per $1,000 of value, this makes the total school district portion of this property’s taxes equal to $1,265. Assuming the same taxable value, approval of the bond measure would not increase the tax burden to a property owner.

If approved, would the district immediately issue bonds for $150 million?

No, the district would not sell all $150 million of bonds immediately and would have multiple bond issuances to fund the projects. Capital projects included in the bond would be implemented over the next several years, and as such, the district would sell bonds at various points in time intended to allow the district to have access to funds when needed to pay for construction and comply with current IRS regulations.